PC on Finance

Buy Now Pay Later PCs, Interest Free PCs & Monthly Payments PCs Available From Palicomp

Two Options - PayPal Credit or Novuna Finance

PayPal Credit for PC

Our 0% interest offer is better than just an introductory offer. Simply spend over £99 and you get 0% interest for 4 months on that purchase. The great thing is you’ll automatically get 0% for 4 months every time you spend over £99. PayPal Credit is the perfect way to spread the cost of those larger purchases.

It’s quick and easy to apply for PayPal Credit – all you need to do is complete a short application form and we’ll give you a decision instantly.

If approved and you accept, you’ll have a credit limit attached to your PayPal account to start using straightaway at thousands of online stores.

Buy PC on Finance

PC on FINANCE, We have the option to provide Buy Now Pay Later or Pay Monthly Finance Computer Deals. Orders can be placed online or over the phone. Simply choose your system, add to basket, choose your finance option and then complete the order. Instead of paying upfront by card you will be forwarded over to our finance provider Novuna Finance to apply for your chosen Finance option. If you are accepted for finance you will have to accept their contract by an online E-Signature or by documents in the post. Once accepted Palicomp will call you to take the 10% deposit, if you would like to leave a bigger deposit than 10% then call us on 01270 898 104 before ordering to do the order and apply over the phone.

ALL FINANCE PACKAGES HAVE A MINIMUM 10% DEPOSIT DUE AND A MINIMUM ORDER TOTAL OF £390

The credit advertised is provided by one credit provider with whom we have a commercial relationship

Buy Now Pay Later - PC

Pay 10% deposit upon acceptance, then pay remaining balance within the term (6 Months) and you will simply pay an early settlement fee of just £29.00

No interest will then be paid or due.

6 Months Buy Now Pay Later - £500 Example, £50 Deposit, Then Pay £450 Within 6 Months + £29 Early Settlement Fee = Total £529.00

Representative Example Buy Now Pay Later

Cash Price £1000.00, Deposit of £100.00. Total Amount Of Credit £900.00

Settle in the Deferment period & Pay only a £29 Early Settlement Fee, total due £929.00

OR Pay 48 Payments Of £28.66, 19.9% APR Representative - Interest Rate 19.9% Fixed

Total Charge For Credit If Paid Within Deffered Period = £29 Early Settlement Fee

Buy Now Pay Later Example

ORDER TOTAL £1000 > 6 Months Buy Now Pay Later > 10% DEPOSIT (£100) > Pay £900 within 6 Months

(£29 Administration fee applicable if paid within 6 Months)

If you do not pay the total amount due within the deferred period the plan will revert to 48 monthly payments @19.9%APR.

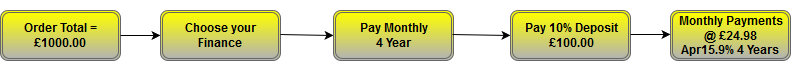

Pay Monthly PC

Pay 10% deposit upon acceptance, then pay remaining balance via monthly payments as quoted. This is at a 15.9% APR representative.

Representative Example Monthly Payments

Price Representative Example Pay Monthly Interest Bearing

24 Months @ 15.9%APR Representative

£1000 Example, Pay £100 Deposit, Then Pay £43.58 a Month for 24 Months

36 Months @ 15.9%APR Representative

£1000 Example, Pay £100 Deposit, Then Pay £31.13 a Month for 36 Months

48 Months @ 15.9%APR Representative

£1000 Example, Pay £100 Deposit, Then Pay £24.98 a Month for 48 Months

Representative Example Pay Monthly Interest Bearing

Cash Price £1000, Deposit of £100. Total Amount Of Credit £900

Interest Rate 15.9% Fixed

You Will Pay 24 Payments Of £43.58 15.9%APR Representative

Total Amount Payable £1145.92

Total Amount For Credit £145.92

Pay Monthly Example

INFORMATION ON BUY NOW PAY LATER £1000 EXAMPLE

I'm now going to give you an explanation about the RPM Countdown Interest Bearing agreement you are applying for.

The purpose of the agreement is to finance your purchase of goods and / or services from us. The agreement would not be suitable for other purposes.

If your application is accepted, your direct debit payments will be £28.66 per month and the total amount you will have to pay under the agreement will be £1,965.28.

The agreement includes a deferred period during which you need make no payments. If you decide to settle the agreement in full during the deferred period, you will be charged no interest (although we will charge an administration fee of £29). If you do not repay the total amount of credit before the deferred period ends, then you will be charged interest on the outstanding balance under the agreement from the date of the agreement until the total amount of credit has been repaid.

If you fail to make payments at the times required by the agreement, Novuna will add details of your default to your record with the credit reference agencies. This could make it more difficult for you to obtain credit in the future. You may also be charged default interest on overdue amounts at the interest rate applicable to your agreement. The interest rate will be stated in the Pre-Contract Credit Information, which will be provided to you if your application is approved. Novuna may also make charges to cover their administration costs if you fail to make your payments on time. Details of these charges and the reasons why they may be made will be set out in the Pre-Contract Credit Information. Missing payments could have severe consequences and may result in legal proceedings being taken against you.

You will have the right to withdraw from the agreement, without giving any reason, for a period of 14 days. The 14 day period will begin on the day after the day on which the agreement is made (that is, the day on which the agreement is signed by us or on our behalf). You can exercise your right to withdraw by giving notice to Novuna, either orally or in writing. The telephone number to call would be 0344 375 5500 and the address to write to would be 2 Apex View, LEEDS, LS11 9BH.

If you give notice of withdrawal, the agreement and any ancillary service contract will be treated as if it was never entered into. You must then repay to Novuna any credit provided (and any interest accrued on it at the rate provided in the agreement) without undue delay and in any event within 30 days after giving notice.

Further Information

Please consider the Pre-Contract Credit Information which will be provided to you if your application is approved. You will be able to take this information away with you.

If you have any questions about the agreement, please call us. If you want to ask Novuna for any further information or explanation, please call 0344 375 5500.

INFORMATION ON MONTHLY PAYMENT £1000 EXAMPLE

I'm now going to give you an explanation about the RPM Interest Bearing agreement you are applying for.

The purpose of the agreement is to finance your purchase of goods and / or services from us. The agreement would not be suitable for other purposes.

If your application is accepted, your direct debit payments will be £43.58 per month and the total amount you will have to pay under the agreement will be £1,145.92.

If you fail to make payments at the times required by the agreement, Novuna will add details of your default to your record with the credit reference agencies. This could make it more difficult for you to obtain credit in the future. You may also be charged default interest on overdue amounts at the interest rate applicable to your agreement. The interest rate will be stated in the Pre-Contract Credit Information, which will be provided to you if your application is approved. Novuna may also make charges to cover their administration costs if you fail to make your payments on time. Details of these charges and the reasons why they may be made will be set out in the Pre-Contract Credit Information. Missing payments could have severe consequences and may result in legal proceedings being taken against you.

You will have the right to withdraw from the agreement, without giving any reason, for a period of 14 days. The 14 day period will begin on the day after the day on which the agreement is made (that is, the day on which the agreement is signed by us or on our behalf). You can exercise your right to withdraw by giving notice to Novuna, either orally or in writing. The telephone number to call would be 0344 375 5500 and the address to write to would be 2 Apex View, LEEDS, LS11 9BH.

If you give notice of withdrawal, the agreement and any ancillary service contract will be treated as if it was never entered into. You must then repay to Novuna any credit provided (and any interest accrued on it at the rate provided in the agreement) without undue delay and in any event within 30 days after giving notice.

Further Information

Please consider the Pre-Contract Credit Information which will be provided to you if your application is approved. You will be able to take this information away with you.

If you have any questions about the agreement, please ask me. If you want to ask Novuna for any further information or explanation, please call 0344 375 5500.